RetireMint is a defined benefit plan with many details that direct its administration and how/when each participant’s benefits begin and how much they will be distributed. We’ve identified a few of the more common plan details participants often want to learn about or understand further. You can also explore the complete RetireMint Summary Plan Description (SPD). The SPD holds the full details of your paycheck-for-life benefit and is a valuable reference for understanding how RetireMint is governed, managed and distributed.

Vesting

Participants become 100% vested in their RetireMint benefit after working and contributing for a period of five years.

- You are always 100% vested in that portion of your Accrued Benefit that you contribute personally (and the interest thereon).

- After five years of service, you become 100% vested in 100% of your accrued RetireMint benefit, including your contributions and your employer’s.

- Vesting service is generally counted from your hire date.

- You must be 21 years of age to participate in RetireMint; however, the hours you work until you are 21 count toward vesting.

Determining contributions

RetireMint is a “contributory” defined benefit plan, but what does this mean to you?

- On an after-tax basis, you contribute a certain percentage of your pay to RetireMint.

- This percentage is determined by your employer and is automatically deducted each pay period.

- Participating Employers contribute remaining funds necessary to ensure RetireMint remains on sound actuarial footing.

Participation and eligibility

Employees who are at least 21 years of age and have been credited with at least 1,000 hours in their first 12 months of employment (or 1,000 hours in any subsequent Plan year) participate in RetireMint. Employees remain in the plan until they retire, terminate employment, become disabled, or die.

Plan Entry Dates: New employees will enter the Plan on the first day of the second month after accumulating 1,000 hours of service (as calculated under the plan eligibility rules), provided that they are at least 21 years of age. Former participants who are re-hired generally re-enter the Plan immediately following their rehire.

Review the RetireMint Summary Plan Description for complete rules and details or contact United Benefits Group with any questions.

Payment options

Once you’ve notified your employer of your retirement date, you’ll begin the process to complete the necessary paperwork, including reviewing/updating your beneficiary, confirming your address, setting up automatic deposit (optional, but recommended!), etc. At this time, you will also review payment options and select the option that’s most appropriate for you based on factors such as marital status, income needs, and personal health. There are nine Optional Forms of Payment that range from an Individual Member Benefit to a Level Income Option to a 100% Joint Annuity. As you approach your retirement date, we recommend you contact us 90-120 days prior to initiate the process and make decisions about payment options.

Benefit accrual rates

Each Participating Employer elects the benefit accrual rate it applies to its employee group. There are five accrual rate options including 2%, 1.75%, 1.50%, 1.25%, and 1.00%. Participating Employers review and select their rate elections annually.

Tax withholdings from retiremint income

You are not required to withhold taxes, but it’s a very good idea. Seek counsel from your tax preparer or advisor to determine how much to withhold. You can withhold both federal and state income taxes (unless your state doesn’t have income tax) either as a dollar amount or a percentage.

Social Security

To help determine whether RetireMint affects your Social Security benefit, consider this “taxability and earnings test.”

YES – Taxability Test

- Your SS benefit will be partially taxable (50%-85%) if your income exceeds various tiers and your filing status

- Your RetireMint Plan benefit is counted as income for this test

NO – Earnings Test

- If you have not reached your SSNRA, you can lose $1 of benefits for each $2 of earnings above $23,400 (for 2024).

- Your RetireMint Plan benefit is not counted as income for this test

Medicare when and how

You are eligible for Medicare at age 65, regardless of your Social Security Normal Retirement Age. We advise that you apply for Medicare three months before you turn 65. Click here to sign up online.

Download the RetireMint Summary Plan Description

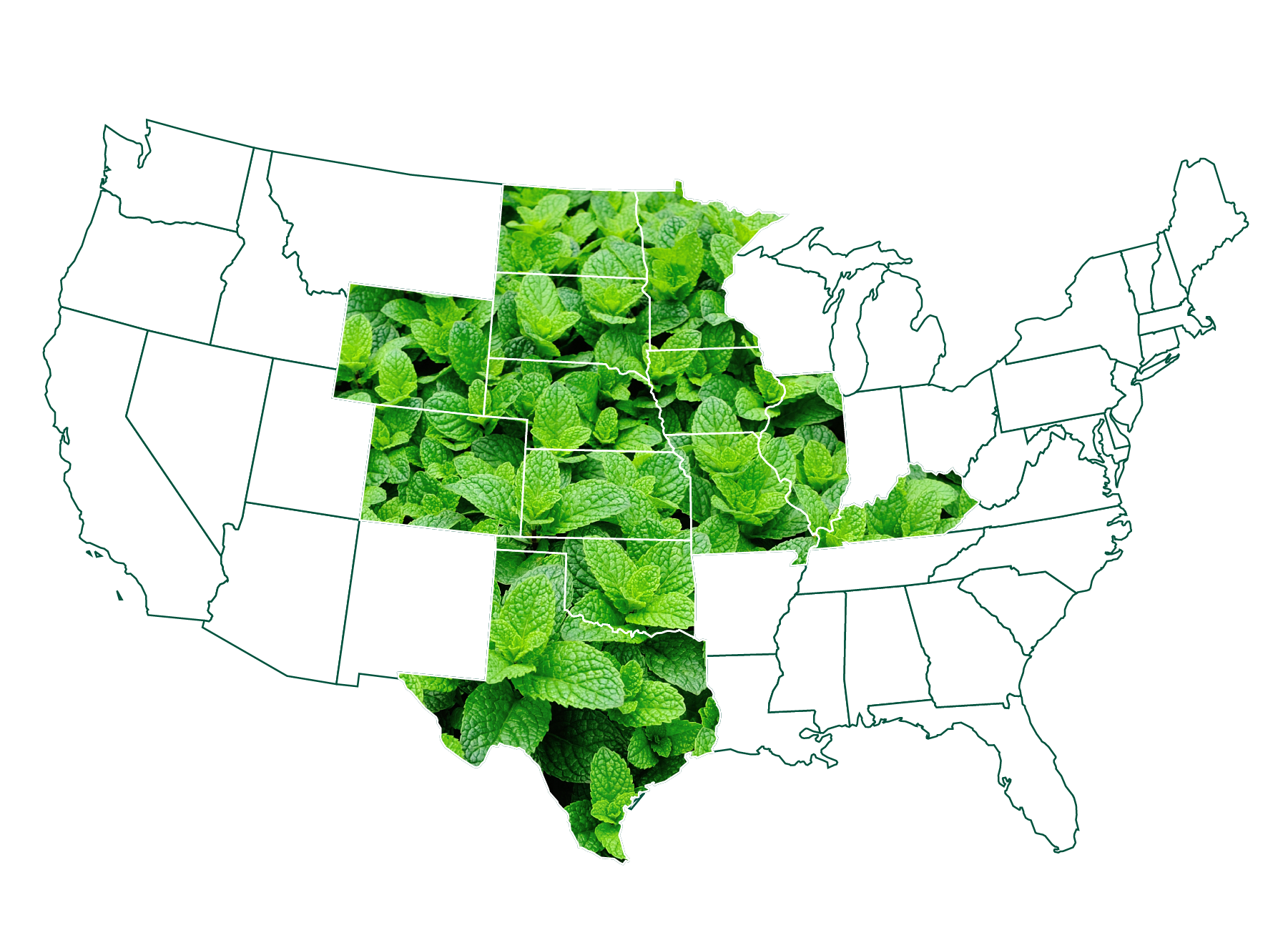

RetireMint grows in 13 states.

Plan participants appreciate RetireMint’s portability, which allows them to transfer their benefit to one of nearly 300 participating co-op employers located across 13 states.

To see if your co-op participates in RetireMint, select your state below: